What is a Quote on Car Insurance? It’s your personalized estimate based on driving history, mileage, and coverage choices—learn how quotes work and how to compare for the best deal.

Introduction

If you’ve ever shopped for car insurance, you’ve likely been asked to “get a quote.” But what is a quote on car insurance, really? Simply put, it’s an estimate of how much you’ll pay for coverage, based on details about you, your car, and your driving habits.

For example Think of it like a price tag before you buy—except the tag can change depending on the information you give. Let’s unpack how quotes work and why they matter.

1) Definition: What Exactly is a Car Insurance Quote?

A car insurance quote is a personalized estimate of your premium, generated by an insurer after analyzing risk factors such as:

Your driving history

Age and gender

Type of vehicle

Where you live

How often you drive

It’s not a final bill—it’s an offer that can change until you officially purchase a policy.

2) Why Do Insurance Companies Give Quotes?

Insurance companies provide quotes so you can:

Compare prices between different providers

See how your personal factors impact costs

Choose coverage levels (liability, comprehensive, collision, etc.) that fit your budget

3) Factors That Shape Your Quote

In addition Not every driver gets the same rate. Insurers tailor quotes using dozens of data points, including:

Driving record: Accidents, tickets, claims

Credit score: In many states, linked to risk

Mileage: More miles = higher risk

Location: Urban areas cost more than suburbs

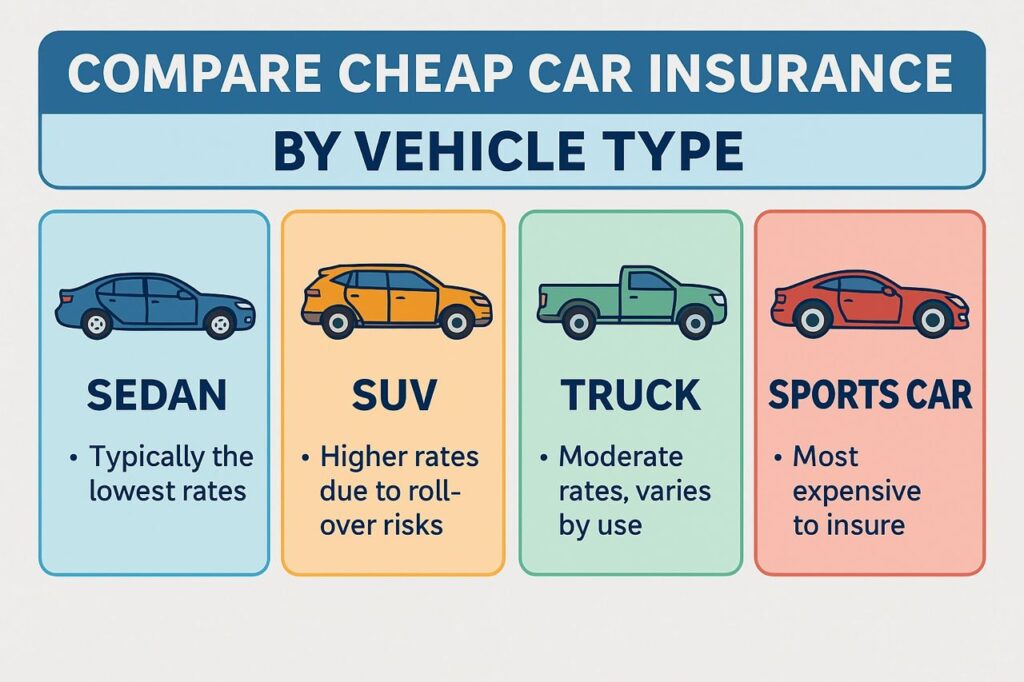

Vehicle type: Sports cars cost more to insure than sedans

Example: For instance Two friends with the same car applied for quotes. One had a clean record, the other had two speeding tickets. By contrast,Their quotes differed by over $600 a year.

4) How to Get the Best Car Insurance Quote

- First, shop around: Compare at least 3 providers.

- Next, bundle policies: Auto + home = discounts.

- Additionally, ask about telematics/UBI: Safe-driving apps lower rates.

- Furthermore, adjust deductibles: Higher deductible = lower premium.

- Finally, update life changes: New job with shorter commute? Report it.

For consumer tips, see the Insurance Information Institute.

5) Quote vs. Policy: Key Difference

Quote: An estimate, not a guarantee

Policy: A binding contract once you agree and pay

Always read the policy carefully—sometimes what looks cheap in a quote comes with limited coverage.

Conclusion

Conclusion

Overall, what is a quote on car insurance? It’s your starting point—a preview of how much coverage might cost, shaped by your unique driving profile. Therefore,The smartest move isn’t just getting one quote—it’s comparing several, adjusting coverages, and asking questions until you find a balance of price and protection.

CTA: Don’t settle for the first number you see. Request multiple car insurance quotes today and see where you could save.