Find out how 2025 credit score affects auto insurance costs. Learn about legal disputes, how to reduce your premium, and why insurers use credit.

Overview

The first question that comes to mind when drivers consider the cost of auto insurance is typically straightforward: How much will it cost? Which business is the most affordable? However, your credit score is a significant factor that is frequently overlooked.

Many insurers continue to base auto insurance rates on credit history as of 2025. Your premium may go up by hundreds of dollars a year if your score is poor, but it may go down if it is high. This article outlines the importance of credit, how it impacts your rates, and steps you can take to safeguard your finances.

A Credit Score: What Is It?

A credit score is a three-digit figure that represents a person’s financial dependability; it typically ranges from 300 to 850. It is determined by your credit history, debt levels, credit usage, and credit record length. The scores are produced by major credit bureaus like Equifax, Experian, and TransUnion.

When determining the interest rate or whether to approve a loan, lenders use it as a guide. It is also used by insurance companies in many states to determine the risk of providing coverage for a driver.

Scores above 700 suggest a reliable and low-risk profile.

Scores below 600 often indicate higher risk, which can result in expensive premiums.

How Credit Score Affects Auto Insurance Prices

An insurance-based credit score is a particular type used by insurers. It uses comparable financial data, despite not being the same as the one banks use.

Strong drivers are rewarded with lower rates because they are viewed as more responsible and less likely to make frequent claims. People with lower scores are viewed as more dangerous, which frequently results in higher expenses.

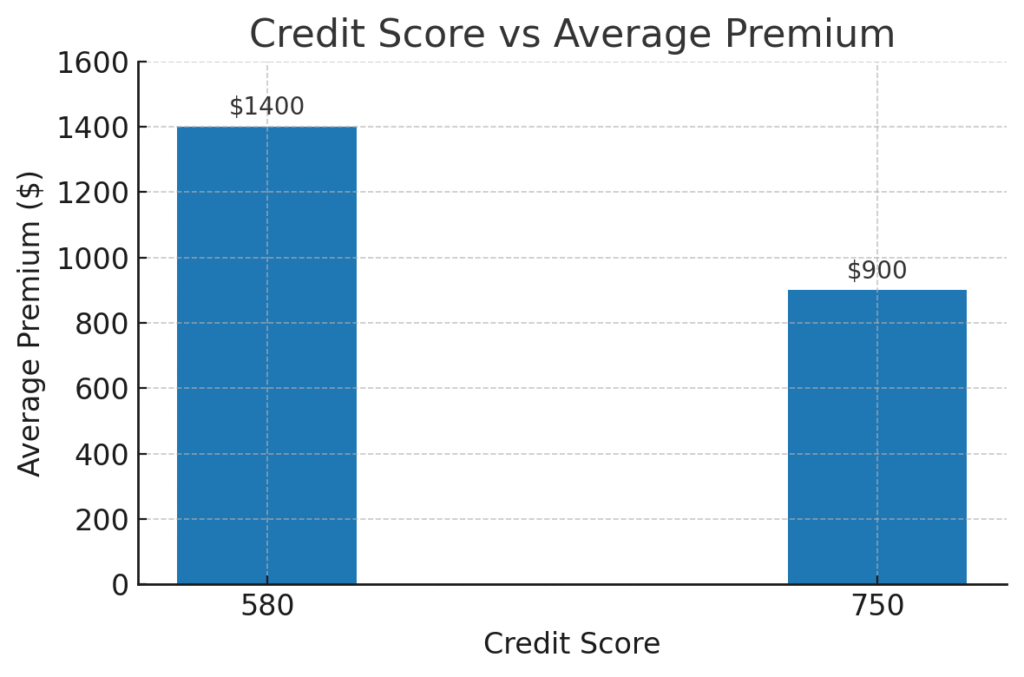

Example: Two drivers have identical driving records. One holds a score of 750, the other a 580. The first may pay $900 per year, while the second could pay $1,400 for the same coverage.

Why Credit Scores Are Used by Insurers

Credit scores, according to insurance companies, are a better indicator of risk than a lot of other variables. Policyholders with lower scores are more likely to file claims and make late payments, according to studies. As a result, credit is viewed by insurers as an extra risk indicator, much like location, age, or driving history.

Critics contest this opinion. They contend that it is unjust to link financial difficulties to insurance premiums. A person’s credit score may drop as a result of financial difficulties like losing their job or incurring medical bills, but these situations don’t always make them a worse driver.

Arguments in favor of credit use in legal and equitable debates:

Pricing is more accurate with predictive value.

Drivers who manage their finances well should pay less for insurance.

Arguments against it:

unfairly burdening people who are already struggling financially.

Insurance rates should be based on driving behavior rather than credit history.

A few states have taken action in response to these worries. The use of credit scores by insurers to determine auto insurance rates is restricted or outright prohibited in California, Hawaii, and Massachusetts. Similar measures are currently being considered by others, demonstrating how contentious the matter is.

👉 Related reading: Full Coverage vs Liability Insurance: Which One Do You Really Need?

Increasing Your Credit Score to Reduce Insurance Premiums

Improved credit directly reduces insurance costs in addition to helping with loans. Here are some doable actions to improve your score:

Make timely bill payments. In scoring systems, timely payments are given the highest weight.

Maintain low balances. Financial control is demonstrated by using less than 30% of available credit.

Steer clear of pointless credit applications. An excessive number of challenging questions can lower your score.

Make responsible use of credit. A solid track record over time fosters confidence with insurers and lenders.

Verify reports for errors. Error correction can raise your score rapidly.

You’re entitled to one free report from each bureau every year at AnnualCreditReport.com.

What to expect in 2025 and beyond

It’s likely that the relationship between credit and auto insurance will shift. Lawmakers are working to restrict or outlaw its use in a number of states. Simultaneously, technology is changing how insurers calculate risk.

Telematics programs monitor real-world driving patterns and incentivize safe driving regardless of one’s financial situation.

Future reliance on credit scores may be lessened thanks to new methods of risk calculation being made possible by AI-driven analytics.

Fairer pricing models that more accurately reflect driving behavior may result from these changes.

In conclusion

Credit scores continue to have a significant impact on auto insurance rates in 2025. While low scores can eventually cost drivers thousands, high scores translate into cheaper premiums. Despite criticism that the system is unjust, the majority of insurers still use it.

To keep yourself safe:

Boost your credit rating.

Examine quotes from several businesses.

Keep an eye on modifications to the insurance regulations in your state.

In summary, your credit score has a direct impact on the price of auto insurance in addition to loans. You could save hundreds of dollars annually if you improve it.

Commonly Asked Questions (FAQ)

1. In 2025, will credit scores be used by all insurance companies?

Not every one of them. Although credit is still taken into account by the majority of insurers, some provide quotes without it. Credit-based pricing is even illegal in states like Massachusetts, California, and Hawaii.

2. Will my insurance immediately drop if I raise my credit score?

Not right away. When you apply for a new policy or renew your existing one, the majority of insurers check your credit. However, over time, lower premiums are typically the outcome of improved credit.

3. Is using my credit score by insurers permitted by law?

In the majority of states, yes. But every state has its own laws. Some limit or outright prohibit the practice.

4. What credit score gets you the best deals on auto insurance?

In general, obtaining the lowest premiums is facilitated by a score higher than 700. Age, location, and driving history are additional significant factors.

5. If my credit score is low, how else can I lower my auto insurance premiums?

Investigate and contrast a number of suppliers.

Combine renters’ or homeowners’ insurance with auto insurance.

Inquire about good student or safe driver discounts.

If you can afford it, think about increasing your deductible.