The minimum coverage for USAA auto insurance is only $36 per month, which is substantially less than the national average of $61. These figures may grab your attention when you’re looking for auto insurance, but what’s causing these affordable rates?

In actuality, the average annual savings for USAA members on their auto insurance is $725. Furthermore, the average monthly premium for full coverage from USAA is $143, which is roughly 30% less than the $203 national average. However, USAA’s remarkable score of 726 out of 1,000 points in the J.D. Power 2024 U.S. Auto Claims Satisfaction Study shows that these savings do not come at the expense of high-quality service.

In this thorough guide, we’ll look at everything from policy limits and driving patterns to vehicle characteristics and individual demographics that affect the cost of your USAA auto insurance. We’ll also go over how to find out if you’re getting the most for your premium money, available discounts, and optional coverages.

Understanding the average cost of auto insurance in the USAA

The pricing structure of USAA makes it clear why military personnel and their families keep coming back to this company for their auto insurance requirements. Let’s look at the costs and how these rates compare to those of other major insurers.

Your location, driving history, and coverage level all affect the cost of your USAA auto insurance. Recent statistics show that the average monthly premium for full coverage USAA auto insurance is about $117 [1], or roughly $1,407 per year. The average falls to about $35 per month [1] or $417 per year for those who are only looking for minimum coverage.

For a variety of reasons, these numbers may vary by state. For example, the average monthly premium paid by USAA policyholders in Texas is $211 [2], which is marginally more than the national average. The main cause of this increase is Texas’s higher risk of natural disasters like hurricanes, flooding, and hail, which in turn has an impact on insurance rates [2].

Furthermore, nationwide analysis indicates that full coverage from USAA costs an average of $1,663 annually according to 2025 data [2]. Despite some minor variations between different sources, most reports consistently show USAA’s rates falling well below industry averages.

Your individual rate might differ based on:

Your driving history and annual mileage [1]

Your location and its associated risks

The type of coverage you select

Your vehicle’s value and safety features

How USAA pricing compares to competitors

USAA consistently outperforms most major insurance providers on pricing. While USAA’s full coverage averages $1,663 annually, the national average across all companies stands at $2,556 – making USAA approximately 35% cheaper than the industry standard.

When compared directly with other major insurers, USAA’s competitive edge becomes even more apparent:

| Company | Full Coverage (Annual) | Minimum Coverage (Annual) |

|---|---|---|

| USAA | $1,663 | $341 |

| GEICO | $2,275 | $492 |

| State Farm | $2,465 | $503 |

| Travelers | $1,776 | $506 |

| Progressive | $2,222 | $649 |

| Allstate | $3,941 | $846 |

As shown above, USAA offers the lowest rates among major providers for both full and minimum coverage. Even Geico, often recognized for affordability, charges about $1,939 annually for full coverage compared to USAA’s $1,722.

The savings extend across various driver profiles as well. For instance, USAA charges about $2,398 annually for drivers with one at-fault crash, whereas the national average for this profile is $3,790. Similarly, drivers with poor credit pay around $3,004 with USAA versus the national average of $4,282.

Nevertheless, it’s worth noting that these significant savings come with an important qualification – USAA insurance is exclusively available to military members, veterans, and their families. Despite this limitation, for those who qualify, the value proposition remains remarkably strong.

Breaking down your premium: what goes into the cost

Understanding what factors into your USAA car insurance premium helps you make informed decisions about your coverage. Your premium isn’t arbitrary—it’s calculated based on several key variables that determine your risk profile and potential cost to insure.

Policy limits and deductibles

Your policy limits fundamentally impact what you pay for USAA car insurance. Higher coverage amounts typically result in higher premiums. For example, Texas requires minimum liability limits of $30,000 for bodily injury per person, $60,000 per accident, and $25,000 for property damage. Although these minimums satisfy legal requirements, they might not provide adequate protection in serious accidents.

Deductibles—the amount you pay out-of-pocket before insurance kicks in—play a crucial role in determining your premium costs. When selecting a deductible for your USAA policy, you’ll generally have options ranging up to $1,000. The relationship is straightforward: choosing a higher deductible generally lowers your premium, while lower deductibles increase it.

Consider this carefully: if you select a $500 deductible and need to file a claim for $3,000 in damages, you’ll pay $500 while USAA covers the remaining $2,500. Unlike some insurance types with annual deductibles, auto insurance requires paying your deductible for each separate claim.

Driving habits and usage

How often and how well you drive primarily determines your risk level and subsequently affects your rates. USAA, like other insurers, has traditionally relied on risk classes—grouping drivers by characteristics like age, vehicle model, and location.

Usage-based insurance (UBI) programs offer an alternative approach. USAA’s SafePilot program monitors your actual driving behavior through a smartphone app, potentially saving you up to 30% on your premium. Upon enrollment, you immediately receive a 10% discount, with additional savings possible at renewal based on your driving performance.

The app tracks factors including:

- Phone usage while driving

- Harsh braking patterns

- Total miles driven

- Time of day when you’re driving

To qualify for the maximum discount, you must drive at least 325 miles and 16 hours during each policy period. Notably, USAA promises that poor driving scores won’t increase your rates—you simply won’t receive as large a discount.

Vehicle value and safety features

Your vehicle’s characteristics substantially influence your USAA premium. More expensive and high-performance vehicles generally cost more to insure because they’re costlier to repair or replace. Insurance companies also consider your vehicle’s safety record and theft likelihood when calculating rates.

Surprisingly, modern safety features provide minimal insurance savings. Despite proven safety benefits, technologies like blind spot monitoring, rear-view cameras, and lane departure warning typically save drivers less than 1% on car insurance premiums. Only electronic stability control (ESC) has been shown to lower rates—and just by about 0.49% (approximately $7 annually).

Anti-theft devices offer slightly better savings, though still modest:

- Passive disabling devices: 0.67% ($9.60) annually

- Tracking devices: $7.53 annually

- Active disabling devices: $5.38 annually

- Audible alarms: $5.04 annually

While these technologies make your vehicle safer, they also make it more expensive to repair when damaged—offsetting potential premium reductions.

How your profile changes your USAA car insurance cost

Your personal characteristics play a pivotal role in determining your USAA car insurance cost. From your age to your driving history, these factors can either save you money or significantly increase your premium. Let’s examine exactly how your individual profile impacts what you’ll pay.

Teen and senior driver rates

Age remains one of the most influential factors in auto insurance pricing. Teen drivers insured through USAA face higher premiums than other age groups, yet these rates are substantially lower than industry standards. A 17-year-old female pays approximately $4,164 annually with USAA, while male teens average $4,424. Compared to the national averages of $6,410 and $7,377 respectively, USAA offers considerable savings for younger drivers.

As drivers mature, their rates typically decrease. Young adults (25-year-olds) pay between $1,612 and $1,685 annually with USAA. Senior drivers enjoy even better rates, with 60-year-olds paying just $1,125-$1,131 yearly compared to the national average of $1,756-$1,813.

Impact of accidents, DUIs, and tickets

Your driving record directly affects your premium. Following an at-fault accident, USAA insurance rates increase by approximately 44% on average. In concrete terms, drivers with one at-fault accident pay around $2,194 annually ($183 monthly).

Speeding violations likewise impact your rates. With a speeding ticket, expect to pay about $1,747 annually ($146 monthly). The severity of the ticket matters too—exceeding the speed limit by 21-25 mph can raise your premium by approximately $460 per year.

DUIs cause the most dramatic rate increases. After a DUI conviction, USAA premiums rise to approximately $2,916 annually ($243 monthly). This represents about 185% more than what drivers with clean records pay. Fortunately, these increases aren’t permanent—they typically affect your rate for 3-5 years, depending on your state.

How credit score affects your premium

Although USAA doesn’t use your actual credit score number to set rates, they do analyze your credit history to calculate a credit-based insurance score. This practice stems from research showing correlations between credit management and claims likelihood.

Drivers with poor credit pay roughly $2,511 annually ($209 monthly). This represents a substantial increase compared to those with better credit histories. Yet, even with this increase, USAA’s rates remain competitive—drivers with poor credit pay about $3,004 annually with USAA versus the national average of $4,282.

It’s worth noting that California, Hawaii, Massachusetts, and Michigan prohibit using credit for insurance rate calculations. In other states, many insurance companies report that most customers actually pay less for coverage because of insurance scores, not more.

Discounts that lower your USAA auto insurance rates

Knowing which discounts to apply for can substantially reduce your USAA car insurance rates. Members save an average of $725 per year, yet many fail to maximize their potential savings. Let’s explore the most valuable discounts available.

Safe driving and low mileage

The USAA SafePilot program offers immediate savings of 10% just for enrolling. Moreover, practicing good driving habits can earn you up to 30% off when your policy renews. The program monitors driving behaviors through a smartphone app, requiring at least 325 miles and 16 hours of driving during each policy period to qualify for the maximum discount.

For those who drive infrequently, SafePilot Miles provides additional savings. This program is ideal if you drive fewer than 8,000 miles annually, offering up to 20% off for lower mileage plus an earned driving discount of up to 20% for safe driving habits.

Bundling with home or renters insurance

Packaging your auto insurance with a USAA property policy can reduce your premium by up to 10%. This multi-policy approach has proven remarkably effective—USAA members collectively saved $1.2 billion by bundling auto and homeowner insurance products.

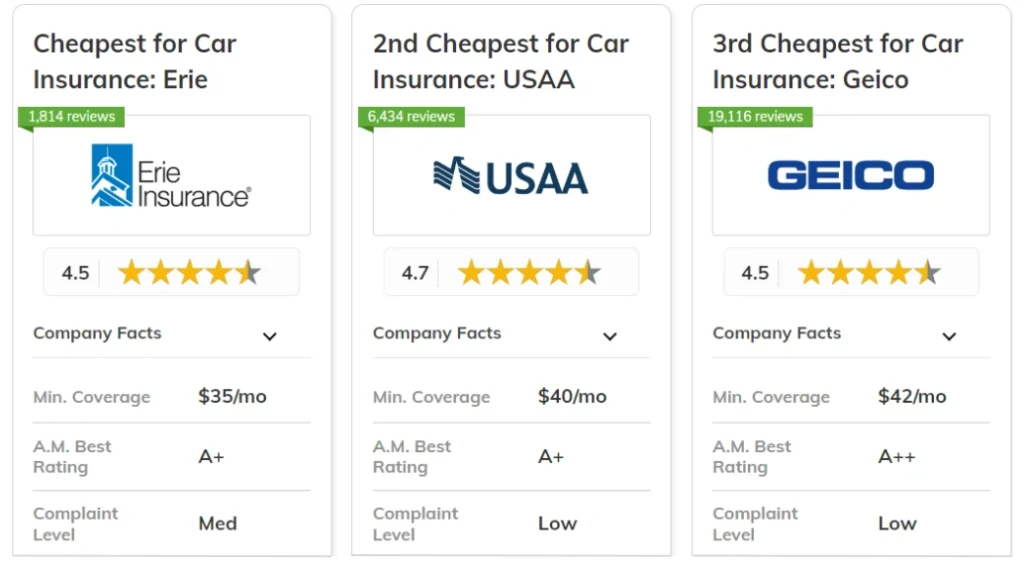

Beyond the percentage discount, USAA consistently offers below-average rates even without bundling, ranking as the second cheapest insurer for car insurance and third cheapest for home insurance.

Military base storage and deployment discounts

USAA members who garage their vehicles on military installations can save up to 15% on their premiums. Throughout deployments, USAA provides guidelines for safely storing vehicles, potentially qualifying you for additional savings.

Many military bases offer designated parking lots for vehicles while owners are deployed. To maximize these discounts, contact a USAA agent directly to learn about deployment-specific options available to you.

Good student and family discounts

Students under 25 years old can qualify for USAA’s good student discount by maintaining strong academic performance. Eligibility requirements include:

- Full-time enrollment in high school, college, or vocational/technical school

- Meeting one of these academic standards:

- Ranking in the top 20% of their class

- Maintaining a B average or better

- Achieving at least a 3.0 GPA on a 4.0 scale

- Making the Dean’s list or honor roll

This discount requires annual recertification through the USAA website or mobile app, with potential savings of up to 10%.

Optional coverages and what they really cost

Beyond standard protection, USAA offers several optional coverages to enhance your auto policy. These add-ons provide extra security but ultimately impact your overall car insurance cost.

Roadside assistance and rental reimbursement

USAA roadside assistance typically costs between $12 and $20 annually, providing 24/7 access to towing, jump starts, fuel delivery, and lockout services. This coverage includes a $100-per-incident limit. Meanwhile, rental reimbursement coverage helps pay for a temporary vehicle while yours undergoes repairs after a covered accident.

Accident forgiveness

USAA offers accident forgiveness through two paths. You’ll qualify automatically after five accident-free years with USAA. Otherwise, you can purchase it as an optional add-on. This valuable feature prevents rate increases after your first at-fault accident. Importantly, accident forgiveness isn’t available in Connecticut, Delaware, North Carolina, California, or New York.

Valuable personal property and flood coverage

For protecting special possessions, USAA’s Valuable Personal Property insurance covers items like jewelry, fine art, and musical instruments. Flood damage, typically excluded from standard policies, can be covered through USAA’s separate flood insurance via the National Flood Insurance Program.

Umbrella and ride-share insurance

USAA umbrella insurance provides up to $5 million in additional liability protection, extending coverage beyond your auto policy limits. For rideshare drivers, USAA offers gap protection starting around $6 monthly, covering you when logged into rideshare apps but before accepting passengers—a period often excluded from personal policies.

Conclusion

USAA car insurance stands out as a premium value option for military members and their families. Throughout this analysis, we’ve seen how USAA consistently offers rates 30-35% below national averages while maintaining excellent customer satisfaction.

The significant savings don’t happen by accident. USAA achieves these competitive rates through careful risk assessment, military-specific discounts, and a membership model that serves a more selective pool of drivers. Nevertheless, your individual rate still depends on personal factors like driving history, vehicle type, coverage choices, and location.

Smart shoppers should certainly take advantage of USAA’s numerous discount opportunities. Programs like SafePilot reward good driving behaviors with up to 30% savings, while bundling home and auto policies can reduce premiums by an additional 10%. Military-specific discounts further enhance the value proposition for service members.

Before finalizing your policy, consider whether optional coverages align with your needs. Roadside assistance, accident forgiveness, and rideshare coverage provide valuable protection but will increase your premium. The key question becomes whether these additions deliver sufficient peace of mind to justify their cost.

USAA membership carries substantial advantages for eligible drivers. Though exclusively available to military personnel and their families, those who qualify benefit from both lower rates and quality service. After all, saving hundreds of dollars annually while still receiving top-tier coverage represents the kind of value most insurance shoppers can only dream about.

Key Takeaways

Understanding USAA’s pricing structure helps military families maximize their insurance savings while securing comprehensive coverage.

• USAA offers rates 30-35% below national averages, with full coverage averaging $143 monthly versus $203 industry standard

• SafePilot program provides immediate 10% discount plus up to 30% additional savings for safe driving behaviors

• Military-specific benefits include 15% base storage discounts and deployment-related savings unavailable elsewhere

• Bundling auto with home insurance saves up to 10%, with members collectively saving $1.2 billion through multi-policy discounts

• Optional coverages like accident forgiveness and roadside assistance ($12-20 annually) enhance protection without breaking budgets

USAA’s exclusive military membership model enables these exceptional rates while maintaining high customer satisfaction scores. For eligible service members and families, the combination of significant savings and quality service makes USAA a standout choice in the competitive auto insurance market.

FAQs

Q1. How much have USAA car insurance rates increased in 2025? USAA car insurance rates have remained competitive in 2025, with full coverage averaging $143 per month compared to the national average of $203. While some insurers have seen significant increases, USAA has maintained relatively stable pricing for eligible members.

Q2. What factors affect USAA auto insurance premiums? Several factors influence USAA premiums, including your driving record, vehicle type, coverage limits, location, and credit-based insurance score. USAA also considers military-specific factors like on-base vehicle storage and deployment status.

Q3. How can I lower my USAA car insurance costs? You can reduce your USAA premium by enrolling in the SafePilot program for up to 30% savings, bundling policies for a 10% discount, qualifying for good student discounts, and taking advantage of military-specific savings opportunities.

Q4. Does USAA offer accident forgiveness? Yes, USAA offers accident forgiveness. It’s automatically included after five accident-free years with USAA or can be purchased as an optional add-on. This feature prevents rate increases after your first at-fault accident.

Q5. How does USAA’s pricing compare to other major insurers? USAA consistently offers lower rates than most major insurers. For example, USAA’s average annual full coverage premium of $1,663 is significantly less than competitors like Geico ($2,275) and State Farm ($2,465). However, USAA is only available to military members, veterans, and their families.